Welcome back to the second half of our deep dive into financial KPIs vital for every agency owner.

If the first three metrics were about growth and profitability, the next four zoom in on stability and future security.

Let’s dive right in!

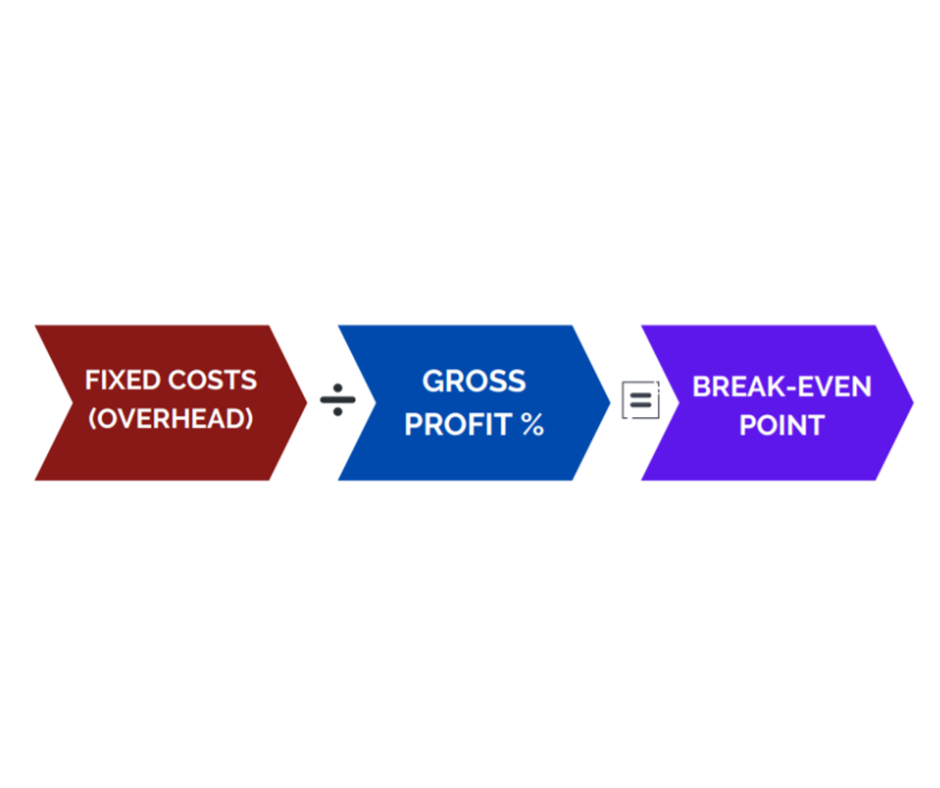

4. Break-Even Point

How much revenue do you need to cover your costs? BEP is the number of sales you must make before all your business expenses are covered and the profit begins.

You have likely been advised this before – when we set up any business, we must ensure that we achieve enough sales to cover our fixed expenses first. We would add up all our monthly overheads and determine the sales required to cover these expenses.

The break-even point is also something that every business owner should ideally be looking at straight from day one in business.

Here’s how you can calculate it:

BEP will tell you:

- The exact amount of revenue needed to cover costs.

- The sales target before you start seeing a profit.

Why it matters: Knowing this point empowers boldness. Once reached, every subsequent dollar is profit, enabling strategic risk-taking and innovation.

By determining your BEP for various business scenarios, you can adjust sales goals and manage costs accordingly, ensuring you always stay on the green side of your financials.

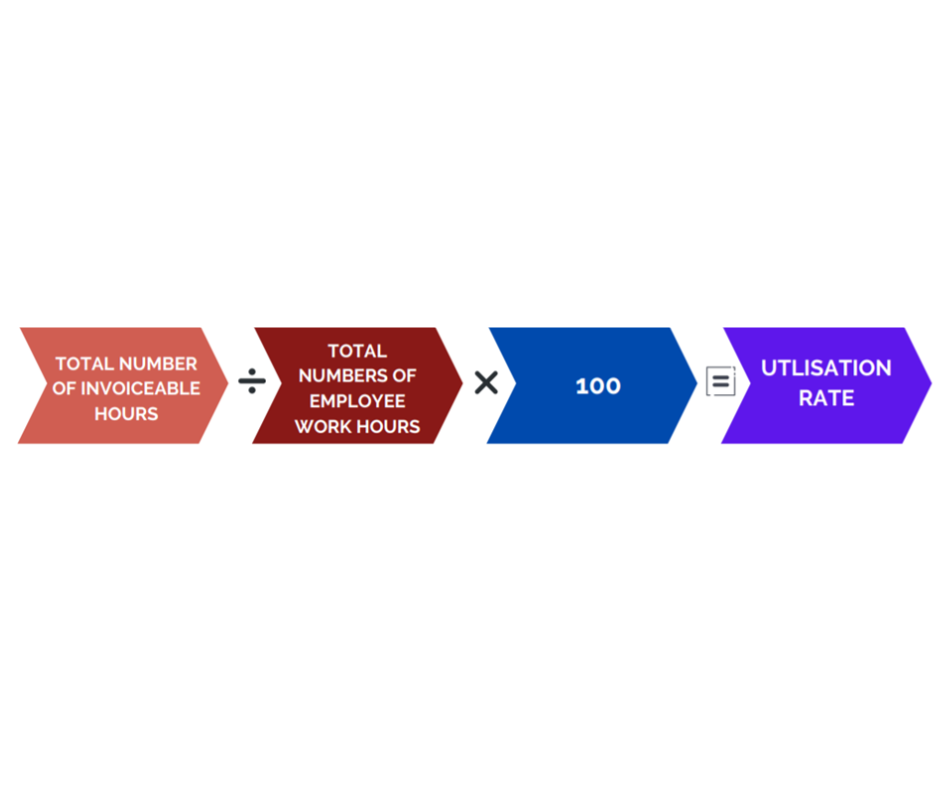

5. Utilisation Rate

Have you ever wondered how efficient your team is? Or if your prices are too low. Track this KPI to know where you stand and where you need to be.

Here’s how you can calculate your utilisation rate:

This KPI sheds light on:

- The productivity of your team

- Whether your pricing is hitting the mark

- Areas of inefficiencies that might be hampering your profitability.

Most agencies achieve a 60% – 80% utilisation rate – but ideally, agencies should achieve between 80% and 90%. What’s yours? If your number falls below 60%, dive deeper into these numbers.

Diligently track your work hours – both billable to the client and actual hours worked. While a utilisation rate between 80%-90% is the gold standard, rates below 60% demand immediate review.

Why it matters: An optimal utilisation rate is the balance between employee satisfaction and profitability. By adjusting this, you refine productivity and increase returns.

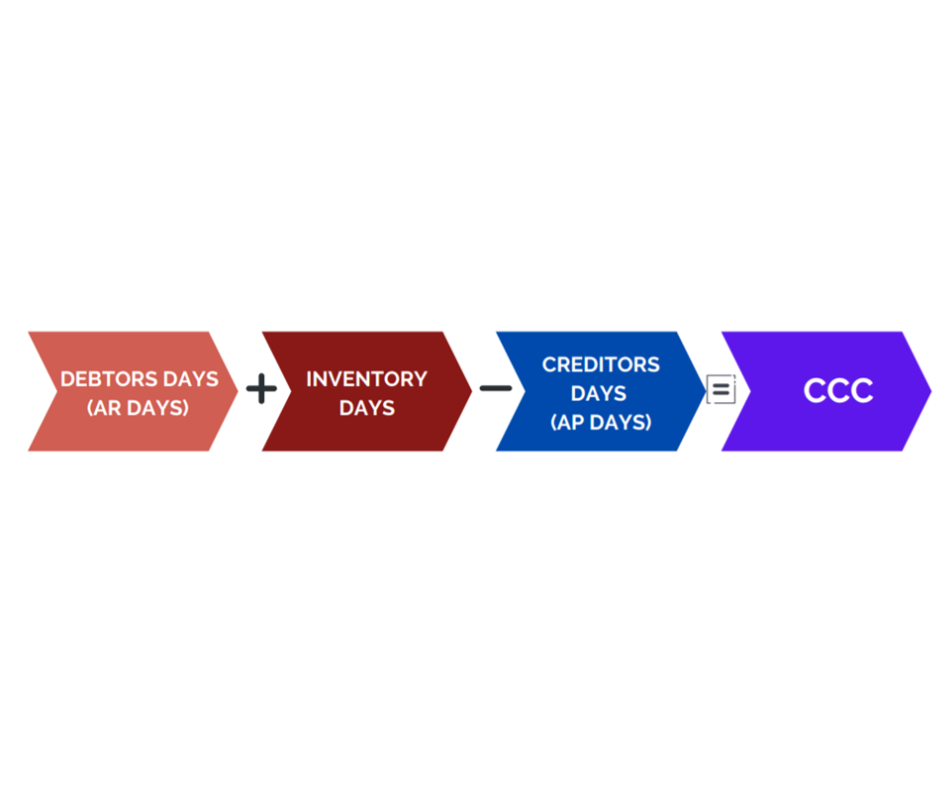

6. Cash Conversion Cycle

Do you have enough cash to run and grow your business? Do you know how quickly you’re able to turn your profit into cash?

Cash Conversion Cycle will tell you how quickly (in the number of days) you can turn your profit into cash. Additionally, it’ll show:

- The efficiency with which you manage working capital within your agency,

- If you’re generating enough cash to handle current financial obligations.

Below is a cash conversion cycle formula:

Inventory days are not relevant for agencies (as there is no physical stock); calculation is even more straightforward: Debtors days (the number of days on average it takes for a company to collect its debt) less Creditors days (the number of days it takes for the company to pay back its payables).

Why it matters: Liquidity is king. A shorter cycle means adaptability, allowing for quicker reactions to market shifts or any changes within the business.

When we talk about cash flow and debt collection – it sometimes requires additional admin work, and the process is often filled with inefficiencies. We usually agree on payment terms with clients and want to ensure they do pay within those terms – but it doesn’t always happen.

This will have a negative impact on the cash conversion cycle. If this is something you’ve had challenges with.

7. Cash Fund or Reserve

Does your business have a safety net? A cash fund that you can dip into when you are in dire need of additional funds?

Consider this your safety net. With a cash reserve, you’re equipped to handle:

- Tax payments

- Salaries and wages.

- Personal expenses

- Unanticipated expenditures.

The pandemic has pushed owners to learn a big lesson and emphasised the importance of a cash reserve. Aim to build a reserve of a minimum of three months’ worth of operational expenses or 10% to 30% of your business’s annual turnover (although depending on the circumstances).

Even though building an emergency fund might seem too difficult for you at the moment, set a goal to slowly but surely start putting money aside to build a reserve for your agency. It’s how you’ll be able to protect yourself from any surprises and take measured risks in the near future.

Why it matters: A robust reserve isn’t just about weathering storms; it’s about seizing sunny days. It allows for decisive action, whether a sudden marketing initiative or a strategic hire.

NEXT STEPS

KPIs are more than just numbers; they are the signposts guiding your business journey. The real magic happens when you take these numbers, understand them, and translate them into actionable strategies.

However, navigating the world of KPIs can be daunting. If you feel overwhelmed, remember that you’re not alone. Our team specialises in helping agency owners like you master their financials, driving growth and ensuring stability.

Do you feel you could benefit from some expert advice? Reach out to us for a discovery call.

Together, we can ensure that your agency doesn’t just survive but thrives in the marketplace.