Numbers tell stories.

In agency ownership’s vast and intricate landscape, they can help us drive action, inspire change, and predict the future. Yet, despite being surrounded by numbers, agency owners still need clarity and transparency about their financials.

If you’re nodding in agreement, this two-part series is for you.

What are KPIs?

KPIs are quantifiable measurements that reflect the performance or health of a business in specific areas. Just as a doctor would measure vital signs to gauge a patient’s health, we can measure KPIs to determine the health and trajectory of our businesses.

For an agency owner, understanding these metrics is pivotal. Not only do they unveil the current status of your business, but they also guide its future direction.

In this two-part series, we’re diving deep into seven financial KPIs that can drive profitability, ensure cash flow, and enhance the overall value of your agency.

Let’s get started!

Why Use KPIs?

- Precision: KPIs allow you to target specific areas in your business, giving you a precise view rather than a generalised observation.

- Direction: With KPIs, you can set clear benchmarks and targets, guiding your strategy and tactics.

- Forecasting: Understanding current performance and market knowledge can allow businesses to predict future outcomes more accurately.

Remember, KPIs aren’t just numbers; they’re stories. They narrate where you’ve been, where you are, and, more importantly, where you’re headed.

Now, let’s clear the air about some common misconceptions about KPIs.

MISCONCEPTION #1: More KPIs = More Growth

Monitoring too many KPIs can spread your focus thin. What’s essential is to target specific indicators that genuinely impact your business’s growth.

MISCONCEPTION #2 Revenue or bank balance solely determines business health

We’re all guilty of this – when I’ve been asked how my business is doing, naturally, the first thing that crops up is the revenue. However, the more you tread the financial waters, the more layers, aspects, and metrics you find that determine the success of a business. Revenue on its own is just not the full picture!

MISCONCEPTION #3 Owners must thoroughly study the business’s financial statements every month

Yes, financial statements are complex to understand. But with the right KPIs, you can prioritise and streamline your focus, enabling you to hone in on vital metrics regularly.

The 7 key numbers that matter

1. Revenue Growth Rate

Without a doubt, revenue goals are the first goals you will focus on as you start and grow your agency. Revenue forms the foundation of any business.

The revenue growth rate KPI helps you understand:

- Whether your business is growing

- Annual increments in sales growth

- The trend of your revenues

- If a deeper analysis of clients, spending, and frequency is required.

Why this KPI matters: A steadily climbing revenue growth rate speaks to market relevance, client satisfaction, and the efficacy of your campaigns. This isn’t just growth; it’s a statement of your brand’s relevance in the market.

Additionally, the revenue growth rate will be one of the most important KPIs considered (as well as monthly recurring revenue if you have a lot of retainer-based clients) by potential buyers.

2. Gross Profit Margin

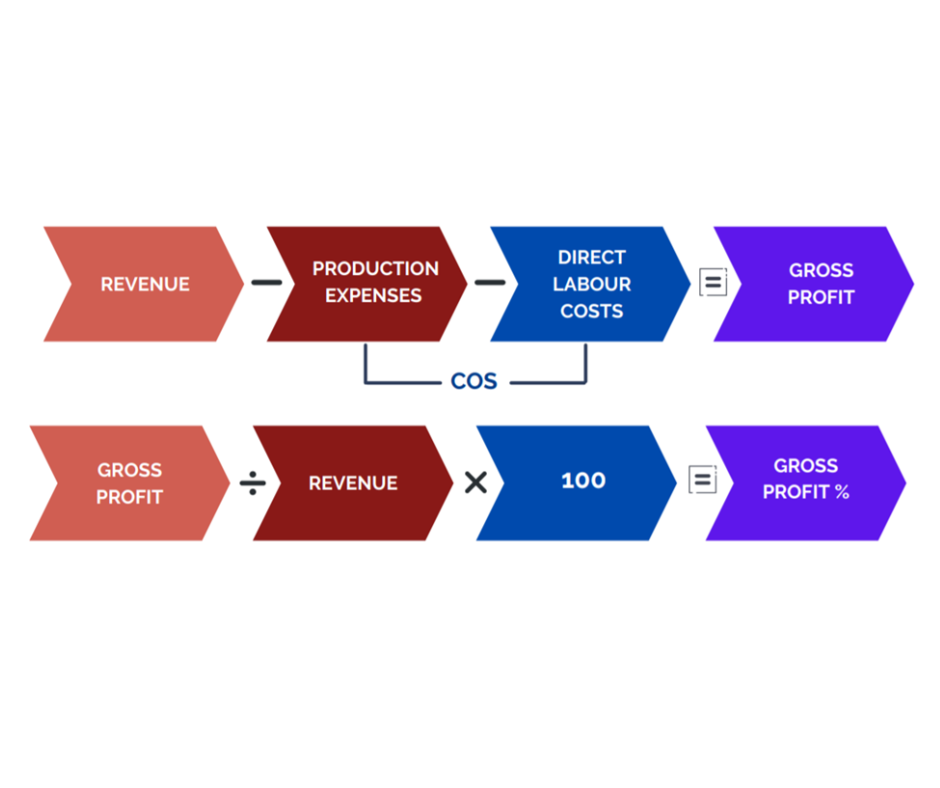

This KPI helps you answer the following question: Do we profitably provide our services? Are we building a business that is both profitable and sustainable? The gross profit margin reveals just that.

Furthermore, it will:

- Assist in pinpointing your most profitable projects (and/or clients) and whether you have sufficient data to calculate it.

- Specify the target margin for maximised profitability.

Why this KPI matters: The GP Margin shows the efficiency of your operations. High revenue with low profit means inefficiency. By discerning where funds leak, you can refine strategies and amplify profitability.

Here’s how you can calculate your gross profit margin:

TIP: When I start working with a client, I often notice that they need an efficient way to monitor their true gross profit. Remember to fine-tune your accounting software to accurately track the cost of sales per department and/or service type.

3. Operating Profit: EBIT, also known as, earnings before interest and tax

This KPI helps you understand to what extent you have been efficient when managing costs and business operations.

If you want to build a great business and then sell it, the operating profit or EBIT is one of the key metrics that help determine the value of your business. Having a decent operating profit shows that you’re able to run a business that is successful, financially sound, profitable, sustainable, and so on.

Wondering how to arrive at this key number? Here’s how you can calculate it:

An impressive EBIT showcases a profitable and sustainable business and is a crucial factor for potential buyers.

Why it matters: It offers an unadulterated view of the core operational health of your agency. Your agency’s profitability isn’t just about the revenue you’re pulling in but more about what you’re keeping after expenses.

A consistent or increasing operating profit margin is a good sign, but a decreasing margin may indicate rising costs or inefficiencies that need addressing.

Three down, four more crucial KPIs to go.

Join us in Part 2 as we show you the numbers that directly impact your agency’s cash flow and long-term value. And remember, knowledge is power – especially when it comes to the financial health of your business.

For Part 2 of 7 Key Numbers that Impact Cash Flow, Profitability and Value of Your Business, head over here >>> 7 Key Numbers that Impact Cash Flow, Profitability, and Value of Your Agency (PART 2)